Annual Income Meaning

As the name suggests, annual income is the income you make in one fiscal year. It comprises everything from your yearly salary, bonuses, overtime, freelance payments, and tips (among other things).

There are two forms of annual income - yearly gross income and net annual income. This article will show you how to calculate and break them down further.

Questions Answered:

-

What does annual income mean

-

Different types of income

-

Calculating annual income

So, What is Annual Income?

The term annual income refers to how much you earn in one fiscal year before any deductions are made for taxes.

The term itself is very explanatory - annual means year and income refers to the money you make.

You typically need to calculate both your gross annual income and net annual income to help with things like creating a budgeting plan, paying your taxes, applying for loans, or proving legal payments, such as alimony or child support.

What Does Your Annual Income Include?

Your annual income can include money from several different sources:

-

Payments from work, such as wages, salary, overtime pay, commissions, bonuses, and tips, before any deductions for tax, pensions, etc.

-

Any social security payments, retirement funds, or pensions.

-

Welfare or disability assistance from the state.

-

Court-ordered payments, such as child support and alimony.

-

Your net income from operating a business, side hustle, or a second job.

-

Interest/dividends from investments or any other net income from properties.

What is Net Annual Income?

Your net annual income is your total income after deductions for taxes and other costs.

This is the figure you would use to calculate your budget to help pay for things like rent, utilities, food, and transportation.

In a business, net income is also referred to as profit - as it is the money a company has made after paying for all of its operating expenses.

What is Gross Annual Income?

Your gross annual income is the amount of money you make in a fiscal year before any taxes or other deductions.

When preparing to file your income tax return, your gross annual income is the base number you should start with.

This will give you a better idea of what taxes you owe or what will be returned to you.

You will also use your gross annual income number to qualify for a loan or credit card from your bank.

If you are a business owner, gross business income is similar; it will be listed on your business tax return.

It is calculated as the total monetary value of your company sales minus the cost of all the goods and services you have sold.

This is a significant number for investors, who will look at your gross annual income as an indicator of your business’s success and potential.

What is Household Income?

Your household income is the total gross income for all household members. The individuals do not have to be related to make up your household income.

Usually, banks and other lenders will assess the risks and base how much they will lend you on your total household income.

Related:

How to Calculate Your Annual Income

Working out your gross annual job income is usually pretty straightforward, and you can use an easy formula to calculate it.

Convert your hourly, daily, weekly, or monthly wages (depending on how frequently you are paid) into their annual value.

Do note that our version of the formula assumes that you are on a reasonably standard contract, where you work an average of 40 hours a week, 50 weeks per year.

- If you are paid hourly, multiply this rate by 2,000 (or your number of hours worked, if not on a standard contract).

- If you are paid daily, multiply this rate by 250 (or your number of days worked if you are not on a standard contract).

- If you are paid weekly, multiply this rate by 50 (or your number of weeks worked if you are not on a standard contract).

- If you are paid monthly, multiply this rate by 12 (or your number of months worked if you are not on a standard contract).

Why is Calculating Your Annual Income Useful?

Both your annual income and the annual income of your household, in total, are good indicators of your financial health.

This significantly impacts your lifestyle and purchasing decisions, as well as gives you an idea of what loans or grants you will be successful in applying for.

You should be informed about the money you have coming in each year to create an accurate budget, set up a savings plan, identify expenses, and understand where and what to spend your money on.

Without a clear picture of your annual income, you could be living beyond your means which would affect you in the future.

If you want to purchase a house, mortgage lenders will look at your annual income but won’t focus on it exclusively, as they will want to see that you have earned a steady income over the last two years.

The consistency of your annual income (alongside other factors, such as your debt-to-income ratio) will inform lenders about how you can make regular payments and the risk they would take when lending to you.

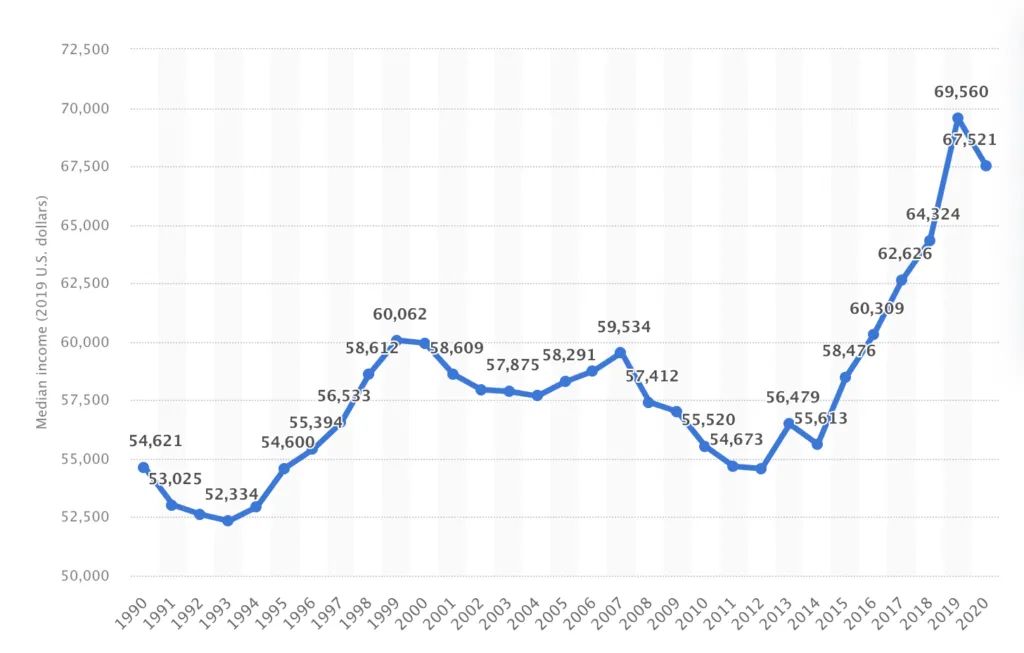

Median US Income

What is a good annual salary?

A good annual salary is whatever you feel most comfortable with in relation to your goals in life and those everyday expenses.

Many variables are in play here, like your age, current living circumstances, and how close you are to retiring (amongst others). The breadwinner of a family of 4 will likely need a higher salary than the recent college graduate living out of his parent's basement.

What is the annual income for $15 an hour?

Based on a standard work week of 40 hours, a full-time employee works 2,080 hours per year (40 hours a week x 52 weeks a year). So if an employee makes $15 an hour working 40 hours a week, they make about $31,200 (15 multiplied by 2,080). - Indeed

What is the annual income for $18 an hour?

Then multiply this number by the hourly wage, which is $18 in this case. Thus, an individual working 2,080 hours annually and earning $18 per hour will make $37,440 a year. - Gobankingrates

Wrapping Up | What does annual income mean

Knowing your finances can save you a lot of time, hassle, and stress, especially when it comes to applying for personal loans, a new credit card, a mortgage, or filing your annual tax return.

Regardless of whether you are an employee or a business owner, you should always be aware of your money so that you can assess your financial health and the health of your business.

We hope this helped - best of luck with your budgeting!

Title: What does annual income mean?

Category: Career Resources

Tags: what does annual income mean, how to figure out my annual income, calculate my annual income, what is annual income example, is annual income monthly or yearly, total annual income, gross income

Co-Author: Reid is a contributor for theJub. He's an employment and marketing enthusiast who studied business before taking on various recruiting, management, and marketing roles. More from the author. | Author Profile